The property investment landscape in Australia is undergoing significant changes, with new challenges emerging. However, there are ample opportunities for those with a clear strategy and the right support. The 2024 PIPA Annual Property Investor Sentiment Survey, which gathered insights from 1,288 investors nationwide, underscores the importance of navigating this complex market with the guidance of experienced professionals. The survey reveals key findings about the current market conditions, including the increasing holding costs, regulatory changes, and anti-investor policies that have led some investors to exit the market, but also the opportunities that still exist.

While rising holding costs, regulatory changes, and anti-investor policies have led some investors to leave the market, it’s crucial to note that opportunities still exist. Now, more than ever, it’s vital to work with professionals to make informed, strategic decisions that can lead to long-term success. This partnership with experienced professionals is beneficial and necessary in navigating the current market challenges. Their expertise can help you understand the market dynamics and identify the opportunities that align with your investment goals.

More Investors Are Exiting, Creating New Opportunities

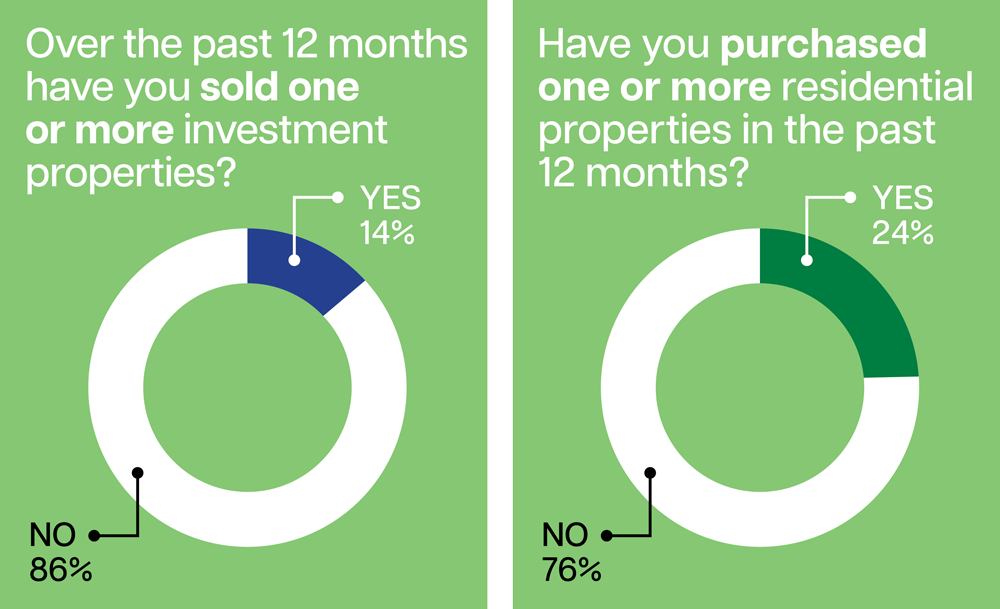

The survey found that 14.1% of respondents sold at least one investment property in the last year, up from 12.1% previously. This trend, driven by rising costs and regulatory pressures, has indeed reduced the stock of rental properties, tightening the rental market. However, for those who remain, this reduced supply creates an opportunity to tap into a more competitive rental environment and potentially higher returns, offering a significant upside in the current market conditions. This shift in the market dynamics presents a unique opportunity for investors to capitalize on the changing landscape.

For buyers, especially investors aiming to expand their portfolios, these sales offer a unique opportunity. As properties transition into the hands of homeowners and first-time buyers, the balance between investors and owner-occupiers is shifting. This shift is not just a change, but a gateway to new possibilities for those who are ready to invest wisely.

Navigating Capital Cities and Regional Areas

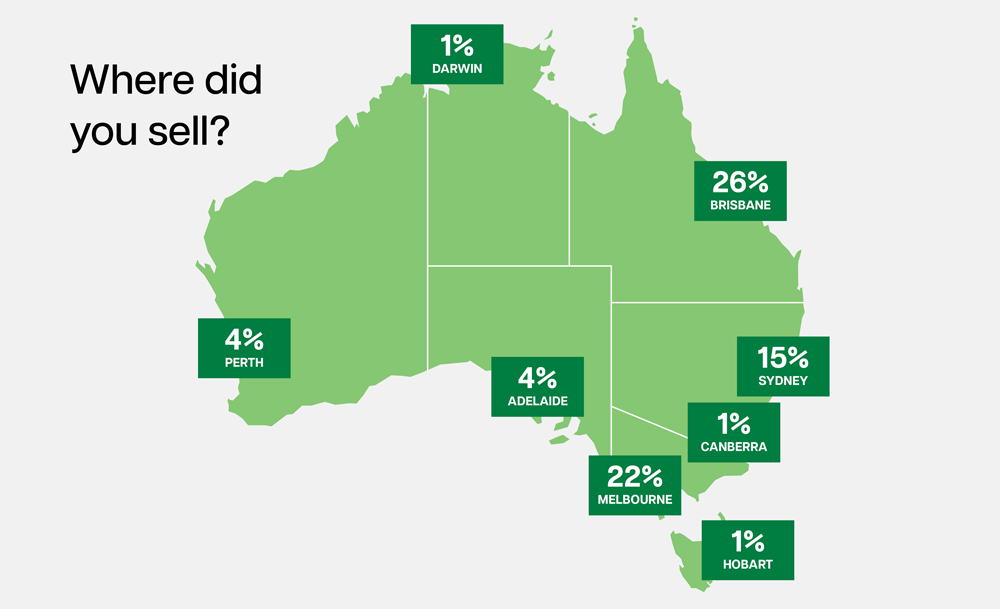

Some of the most significant changes in rental supply have been in major cities, such as:

- Brisbane: 26% of respondents sold a property here, up from 23.3%.

- Sydney: A notable increase to 14.9% from just 8.9% last year.

- Melbourne: Although fewer properties were sold this year (21.7%, down from 24.8%), the long-term potential remains strong.

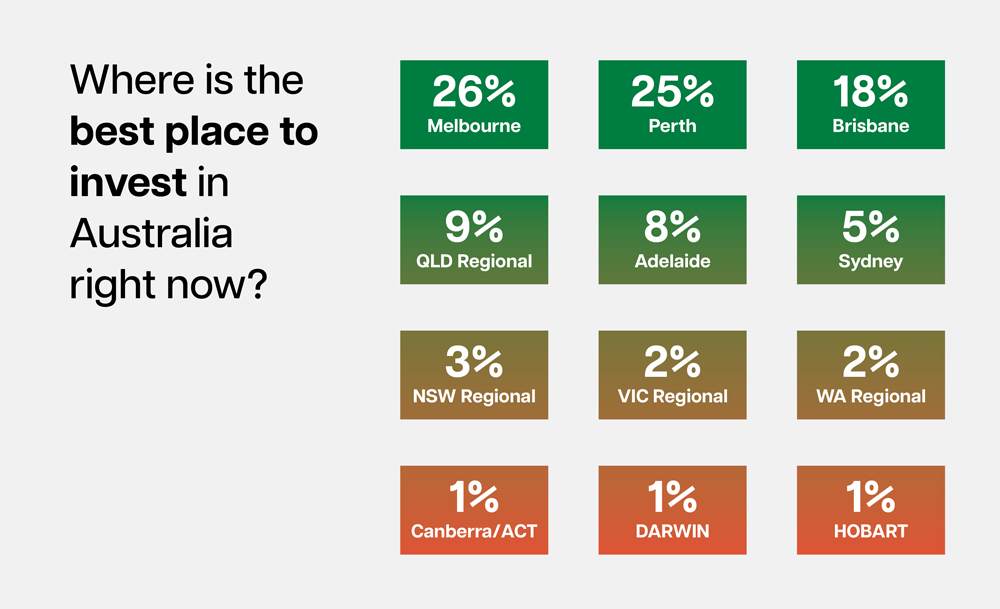

While these figures might indicate challenges, they also signal opportunities for investors who understand market dynamics. Capital cities like Melbourne, Perth, and Brisbane still offer excellent prospects for those willing to plan long-term, particularly in under-supplied rental markets.

In regional areas, Regional NSW, Regional Victoria, and Regional Queensland remain attractive, especially for investors looking for stability and growth over time.

Despite Cooling Sentiment, Key Markets Remain Strong

While the overall sentiment has cooled, with 45.7% of investors believing now is a good time to invest (down from 56% last year), key markets show signs of resilience and growth potential. Melbourne continues to be viewed as the top location for future capital growth (26.2%), followed by Perth (25.1%) and Brisbane (17.8%).

Savvy investors recognise these opportunities and position themselves to take advantage of them, especially in markets set for long-term growth. Working with a team of professionals ensures you make decisions based on expert knowledge and data rather than being swayed by short-term sentiment.

Managing Costs and Overcoming Challenges

It’s clear from the survey that rising costs are putting pressure on investors. Critical reasons for selling include:

- Increased holding and compliance costs (44.1%)

- Increased land tax and government charges (35.4%)

- Reducing total debt exposure (32.9%)

Despite these challenges, there are ways to manage these costs more effectively. Partnering with professionals, from property managers to financial advisors, can help investors develop strategies that maximise returns while minimising exposure to rising costs. This could involve refinancing strategies, optimising rental income, or leveraging tax benefits that might go unnoticed.

Anti-Investor Policies: Navigating the Regulatory Landscape

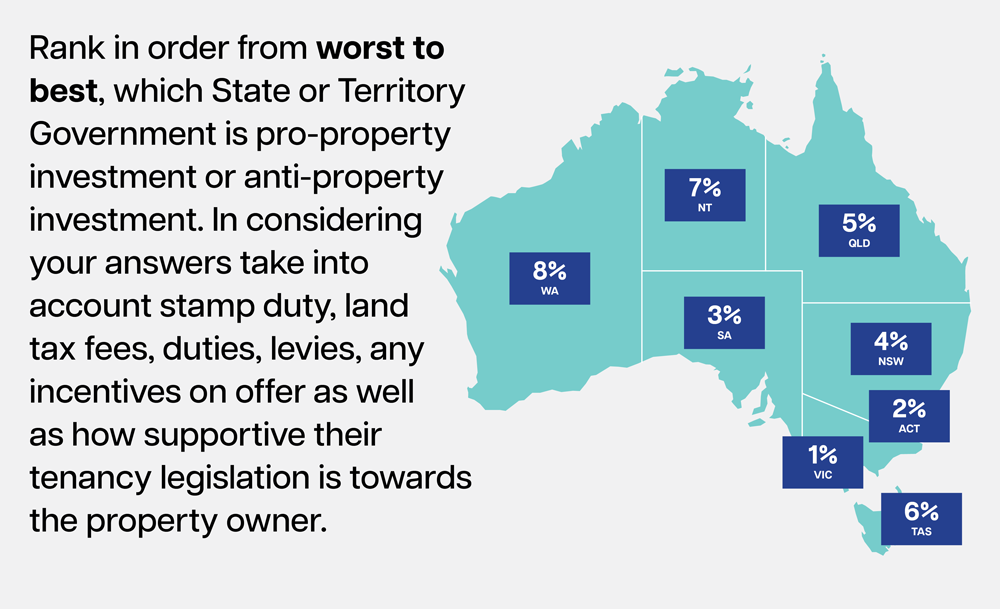

Due to increased regulations, Victoria, the ACT, and NSW remain viewed as less accommodating states for property investors. However, Western Australia and Queensland are seen as more investor-friendly after Queensland reversed its controversial interstate land tax policy.

By understanding the nuances of these regulatory environments, investors can position themselves to make intelligent decisions. Experienced property advisors can help navigate these regulatory complexities and identify opportunities aligning with market trends and government policies.

Unlocking the Opportunities of 2024

While the 2024 PIPA Sentiment Survey highlights rising costs and a shifting landscape, it also points to new opportunities for well-prepared people. Whether capitalising on tight rental markets, acquiring properties in growth regions, or managing rising expenses, the key to success lies in working with a trusted team of professionals who understand the intricacies of property investment.

Final Thoughts: Strategic Guidance is Key to Success in 2024

Adapting and responding to market conditions is crucial as the property investment landscape evolves. Working with experienced professionals can provide you with the insights and strategies needed to navigate rising costs, shifting sentiment, and regulatory changes.

With the right team by your side, 2024 could be the year to capitalise on long-term growth opportunities, even in the face of market challenges. Now is the time to act decisively, guided by expert advice, ensuring your investment strategy aligns with your immediate and long-term goals.

CLICK HERE to download the full PIPA 2024 Investor Sentiment Survey report to gain further insights and plan your next steps in this dynamic market.

For more information, visit www.ifpadvisory.com.au or call our office at (08) 8423 6176 to speak with our Managing Director, John Tsoulos.

IFP Advisory is an Accredited ASPIRE Property Advisor Network advisor and all professionals are Qualified Property Investment Advisors (QPIA).

Property investing is about purchasing a property that aligns with your goals and investment strategy. You should never be sold an investment. Know your numbers! If you invest wisely and strategically, the Australian residential property market can be a rewarding venture.